At the time I made my observations on the Centrelink data match program that raised Robodebts I held a Diploma of Accounting with currency.

Centrelink's overpayment accounts better known as Robodebt in accounting are an "undue" or "unduly" paid special transaction also known as a general journal adjustment. A transaction is a summary in accounts of a financial event & in accounting. What determines a special transaction is they are often a correction of another transaction and/or relate to a prior reconciled period. Examples are returns of faulty products for credit. When the product is returned, it still relates directly to the old financial event (the sale of goods), but the return & credit often occurs in a different accounting period. The value of the original transaction itself cannot be adjusted unless it is within the same accounting period. At the end of each period "balancing the books" occurs & applying any adjustment changing figures, would unbalance books already reconciled. So, a special transaction is needed to show it relates to a prior period.

The overpayment is not a new transaction or financial event, that represents a new activity. It is a correction of an old transaction and in order that it "faithfully represents" that it is part of the old event needs a special transaction. The reason it has always been done this way, is so large company accountants with many workers, on analysis, can pick up repeat errors in processing, or a product batch fault.

Accountants then can also make "disclosures" advising about the cause and timings of unusual events. A business may be consistently profitable, but a once in a lifetime event occurs eg COVID19 that bankrupts or severely affects the profits of a business in certain periods. This exert from the ATO is from the Australian Accounting Standards Board (AASB) link on COVID19. It was chosen to display the currency of AASB101.15 which is one of the most fundamental principles in accounting that accounts have a presentation that faithfully represents transactions.

Another type of special transactions is overpayments. This is where businesses accidently pay an account twice or pay additional money in error to an invoice value. The accountant has no financial event it can directly link the additional payment to & the unduly paid overpayment will be refunded or applied to another transaction at a later date. So, the accountant must if there is no facility create a special account or suspense account to show the location of money, that is an asset of the business, showing a customer's liability to the business. In Centrelink's Robodebts its claim was that it overpaid accounts. That immediately placed the onus of proof on Centrelink to prove that an overpayment occurred & how it had calculated or arrived at the decision it had a right to claim in line with long held common law practice of accounting. Centrelink accounts were at best guesses & rough estimates they were not a faithful representation or even proof any overpayment occurred.

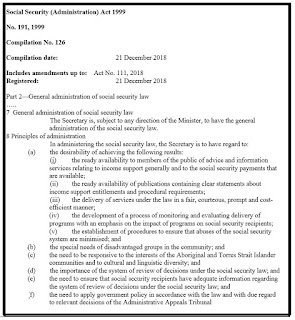

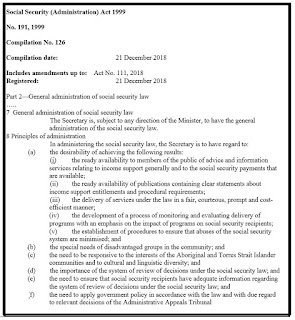

The Acting Ombudsman in first review determined Centrelink had a right to ask for more information. I challenge that based on common law practice of the treatment of unduly or undue process per the Spanish Civil Code 1900 (ref Part 1). Centrelink designed the source documents the benefit application forms that Centrelink customers completed for benefits. They also supplied the brochures on how to complete applications & qualification. Additionally, Centrelink had orientation meetings that explained responsibilities of new claimants and every single benefit form included notes on the back advising of changes. If the initial applications & explanations were processed correctly, then any problems should have been identified at the application stage. Benefit payment forms included a reminder about notifying of changes. The Social Security (Administration) Act 1999 Part 2 8 Principles of Administration are clear that Centrelink must provide information on income support (8(a)ii) and have had regard to the "special needs of disadvantaged groups". Centrelink's processes if performed in a manner that respected the Section 8 "Principles of Administration" should have removed any possibility that it was anything, but welfare fraud. Centrelink though trashed the "Principles". Centrelink even ignored 76 warnings from the Administrative Appeals Tribunal on its legality (see 8(f)).

Even now under its rebranded name the Department of Social Services is refusing to stop issuing data match accounts and has ignored the Amato Court ruling that it must use "suitable information". It is still denying that it issued other types of data match accounts, that it used equally unsuitable information in, that are also rightly due for a credit. Let's be very clear here, this is taxpayer's money being paid back to taxpayers. Centrelink has determined to limit the unlawful accounts to only those that exactly mirror the Amato account. It is like saying one sugar filled lolly is healthier than another sugar filled lolly, because it has a different flavour.

Assume for a moment the Centrelink algorithm was not grossly flawed. If genuine mistakes had occurred by customers, to the degree we've seen an awful lot of people got it wrong. In about 10 years over 2.5 Million Robodebts were issued. That's about a tenth of the entire population children included. Let's not also forget Centrelink's responsibilities in administration to the vulnerable. The estates of about 3,000 deceased people got Robodebts and then there are mentally disabled people who should have had an abundance of help to get their claims right by Principle 8(b). This is an extraordinarily high percentage of the people to either make mistakes or be welfare frauds. When you realise that it is clear these accounts were raised by negligence on Centrelink's party or were designed from the start to be malicious & punitive in nature. Centrelink was pursuing all high value accounts as potential fraud & that is further evidenced by the presence of Australian Federal Police in the form of Taskforce Integrity. In my Robodebt enquiry letter that noted data matching, there was no advice that data matching was used for fraud detection. The letter failed to explain any details regarding even the benefit or the period from which their enquiry related, there was no mention of a possible debt. The letter threatened my benefits if I did not respond. Government effectively instigated a threatening search based on nothing & used undue menace.

When I attended the offices of Centrelink I provided a proof of enrolment letter, that I note still bore the Centrelink stamp from when it had been supplied almost 2 years prior. That document must have been deleted from my file. In my AAT I identified multiple documents that had been deleted from my file. Accounting is a process that relies on source documents. It involves a whole of process evidence stream that summarises information at each level in the process, but the final reporting summary must always be able to be evidenced by the source documents of the original transactions. An Accounting Information System (AIS) is not fit for accounting purposes if it can not access source documents.

In accounting, overpayments do not usually raise an additional account. The balance though appears on customers statements as an unallocated payment. I'm guessing Centrelink raised the accounts because it was visually easier for people to understand this was an amount it claimed was owing to them. Technically, as Centrelink was claiming these were valid accounts the Robodebts were an asset so very big questions should be asked on how they were processed. Were debts moved to Bad & Doubtful Debts when debts were in review? I doubt it because while my debt was in review I had repayments forced on me. There would have been a need to reconcile to debt collectors reports & validate fees so I suspect a separate & possibly suspense General Ledger set was created in the Chart of Accounts with the intention to transfer balances at the end of periods in a single transaction.

Despite me resupplying source documents that showed I was an enrolled student, Centrelink ignored the source document & processed an account for $5,714 falsely stating I was not an enrolled student in their claimed period. In the Centrelink Senior Officer Review the Officer admitted he knew I was an enrolled student, but unless I agreed to let him breach my privacy with unnamed third parties so he could go on a pfishing trip I would have a long drawn out credit process, which is what I got. I had to go to Tribunal to prove my innocence.

From above and my reading of Annual Reports for DEEWR, DHS & Centrelink I am firmly of the belief the alleged debts have nothing to do with raising genuine anomalies for answers. I have maintained all along my data match Robodebt was punitively & maliciously given & my consideration of the number of flaws in the program were it was to create an infrastructure expenditure running stream to fix its many faults.

Example:- In my Authorised Review Outcome I was aware that the Officer did not quote the full laws or quote the Act Compilation (version) so I went looking why. What was clear was that Centrelink's data matching program was only capable of recognising one Compilation. In accounting if a system is not able to show it can recognise the laws applicable at the time accounts are raised the entire program is deemed non-compliant. When viewing the sections of the Act in the relevant compilation in full it favoured my case & not Centrelink's. Almost every year there are changes to taxation tables. Modern day accounting information systems close off each year to enable new years to reflect those changes. Social Security Act changes are sometimes retrospective (created but applicable from a past period of time). It is unjust that Government should be able to change laws at a whim & then be able to claim money was unduly paid because of the changes it has just made.

Example:- The Authorised Review Officer ignored twice information provided that showed I had received a Special Circumstance remission to arrive at a finding there were no special, circumstances that warranted a full waive. These considerations showed the Authorised Review Officer was not providing an impartial review, but was compounding the punitive treatment of Centrelink staff up to that stage.

Many have heard bandied the 26 fortnight algorithm. If asked how many weeks in a year there are in the Western world most people would comment 52 weeks. Asked how many fortnights & you'd get a response 26 fortnights. In reality though these answers are wrong. We have a Gregorian calendar that has 365 days & 366 each leap year. If we divide 365 by 7 which is the number of days in a week the answer is 52.14285714285714. Likewise division by 2 of these numbers for fortnights fails to produce a whole number because there is an additional day. Put another way - Days in a Fortnight 14 x 26 = 364 + 1 extra day equals = 365 days in a year & plus 2 extra days equals 366 days in a leap year. When you consider these sums you realise in any year you could have 53 days when your business prepares wages if paid weekly or 27 fortnights. Centrelink's entire concept of dividing ATO's group certificate of Annual Summary by 26 fortnights was always wrong. The program build start was in 2015 and the first accounts went out after July 1, 2016. The testing therefore was done in a financial leap year, when the implications of the extra days should have sunk home.

Employers also had the same Gregorian calendar phenomena occurring on their payroll pay dates. Add in annual bonuses, adjustments for industry pay rises on 1st October that related to backdated periods, leave loading for permanent casuals that historically occurred. There are too many one off events in a pay year that would cause variations in pays before even consideration of part years worked that would enable Centrelink to accurately do calculations by pro rata days either.

Fuzzy logic was another fault reported, but in my opinion this threat was overblown to hide the real problems of the system. In modern accounting businesses are set up in a card file. Technically businesses should be set up as their registered name with their Australian Business No. & an address. Including an abn lookup & stressing that the correct registered name & address is used by customers when reporting income would have reduced the vast majority of these very cheaply.

Centrelink also had Working Credits, which in exchange for time served doing Mutual Obligations colloquially known as Work for the Dole participants could earn up to a 1000 credits equal to $1000 earned without if affecting benefits. If genuine my check of a debt collectors manual leaked to the internet showed no sign this was ever considered.

I received wrong dates on receipts, wrong dates on even the amended ATO summary I received. There is no way this newly created program had been tested properly. In my opinion the program had been poorly time synchronised for networking.

The real cruncher though is far more damaging for historic data matching than the algorithm. Centrelink had a totally different point of pay recognition to ATO. Centrelink required customers to provide estimates of earnings even if those earnings had not been paid. ATO in stark contrast only deals with actual paid by the employer income. This means income could be estimated earned to Centrelink in one year, but appears on the ATO group certificate for the following year. Unless Centrelink had the actual payslips with days that comprised the ATO group certificate or payment summary Centrelink had nothing. This should have been picked up in feasibility. Government has since been implementing Single Touch Payroll (STP), which would facilitate the pro-rata day calculations, but that won't be fully rolled out until 1 July 2021. Ergo, useless for historic data matching.

The Acting Commonwealth Ombudsman's report that avoided the lawfulness determined the 20% error ratio was acceptable, because it was the same error rate computerised as manual. This logic is ridiculous. If a computer program is working properly it should have a better accuracy rate than humans on the same task, because it does not make human errors. The acceptable level for errors in Government administration is less than 2%.

If you want more information on this topic I'm happy to supply it free of charge & request no information is given me that identifies you in anyway. Stay tuned for Robodebt - Part 4.

Comments

Post a Comment